This week on The Weekly Dose I’m taking a look at my #1 all-time favorite report that was released last week by Rob Kelly over at Ongig! The Top 100 Applicant Tracking Systems in 2018 is an annual report that Rob and the Ongig team have been putting out now for four years.

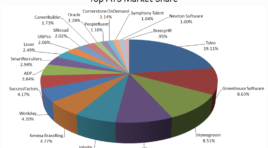

The ATS market is really hard to get data. This report measures 118 ATS platforms out of more than 1,000 on the market, but the 118 in this report make up the vast majority of the marketplace. I love this report because of how robust the data is. The report pulls ATS information from 4200+ employers, which makes it more comprehensive than anything else you’ll find.

So, what have learned about the ATS market in 2018?

– Taleo is getting killed! In 2017 their market share was 25.51% on Ongig’s report, in 2018 their market share dropped to 19.11%. While this isn’t exact, you can bet the Oracle/Taleo people are freaking out and some folks are getting fired! My hope is this will spur the Taleo folks to finally see their solution has fallen behind the marketplace and we’ll see big innovation from them in the coming years.

– Greenhouse is moving upmarket and taking market share in a big way! Greenhouse is getting most of this market share increase from Taleo, Kenexa/Brassring, and Jobvite (who all lost market share since the 2017 report).

– Don’t look now but Google Hire just became a real threat to all SMB ATS providers! In 2017, Google Hire came in at .22% market share #44 on the list. In 2018, Google Hire is .78%, #23, but has increased their client growth by 312%! Almost triple anyone else. Don’t sleep on Hire!

– While Greenhouse is killing everyone in overall growth, iCIMS and Workday are also growing at a very high rate. Suite HCM talent solutions (like Workday Talent, Ultipro, SAP, Oracle, etc.) have some built-in advantages to growth. If you’re using their HCM, you’ll feel pressure to use the rest of the suite. But with the growth of Greenhouse, iCIMS, Lever, SmartRecruiters, etc. (best of breed talent solutions) we see a clear indication that organizations that see talent as a priority are choosing the better tech over the suite solutions.

– The ATS market is growing. Ongig measured 50 different ATSs in 2014, and 119 in 2018. One major reason is you can make money selling ATS solutions primarily because most companies don’t switch ATSs often. So once you get in, you’re usually there for a while. Plus, the options at the SMB level are now very robust with Google Hire (they want us to just call it “Hire”), Workable, BreezyHR, and Newton (now integrated with Paycor).

So, how should you use this report?

I love this report because it truly gives every talent acquisition leader a true picture of how vast the ATS market is. The ATS is foundational to your TA Tech stack and the choice you make for your ATS will dictate many decisions you make in how you recruit talent.

Do I go right to the most used? No, but I also don’t ignore the most used. There’s a reason people are using Taleo and Greenhouse. They work. There’s a reason some systems are growing and some are not. Figure out what those might be, it’s very telling!

If you’re an SMB you have a bunch of low-cost ATS technology you should be looking at. So, there’s no reason you shouldn’t be using an ATS, even if you only hire one person a month. While “Homegrown” ATSs are still used widely, please don’t go develop your own ATS, it’s not worth your time or effort with so many great products already on the market.

Go check out the report – it’s one of the best reads you’ll have all year in TA Technology!

The Weekly Dose – is a weekly series here at The Project to educate and inform everyone who stops by on a daily/weekly basis on some great recruiting and sourcing technologies that are on the market. None of the companies who I highlight are paying me for this promotion. There are so many really cool things going on in the tech space and I wanted to educate myself and share what I find. If you want to be on The Weekly Dose – just send me a note – timsackett@comcast.net

Hi Tim! I read all of your posts on applicant tracking systems. What systems do you recommend for an organization with 200 employees and 0-25 positions openings? We currently use iCIMS, but are in the process of transitioning to Paylocity. Higher-ups liked the idea of having an all-in-one HRIS. Unfortunately, Paylocity appears to have oversold their product and we may not continue with the implementation. Personally, I am not a fan of their recruitment system and would prefer to stay with iCIMS or move to a growing ATS. I welcome your thoughts and opinions!